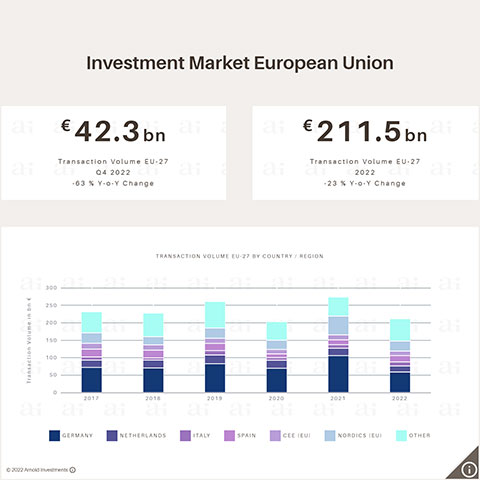

Vienna, February 15, 2024 - Following the trend throughout 2023, the investment market in the European Union closed with a subdued fourth quarter (Q4 2023: €29.6 billion). The total investment volume amounted to €115 billion. Compared to 2022, this represents a decrease of 49 %. The major Western European investment markets of Germany (-54 %) and the Netherlands (-55 %) recorded below-average investment activity, whereas the Southern European markets of Spain (-39 %) and Italy (-45 %), as well as the Czech Republic (-26 %), performed better than the EU average. “Private investors and owner-occupiers supported the market with a historically high share of 44 % of the total volume” reports Markus Arnold, CEO and sole owner of Arnold Investments. Arnold expects a noticeable recovery of the market by the second half of 2024, along with a stabilization of market values in sought-after asset classes.

According to the latest market analysis by Arnold Investments, on the supply side, the year 2023 was dominated by portfolio restructurings among large institutional owners and open-ended real estate funds. Only minor further price corrections are expected until mid-2024. Prime yields are projected to settle in the second half of 2024. “Currently, many investors are waiting for the momentum to re-enter the market,” says Markus Arnold. This could happen soon, as forecasts**) suggest that the first ECB interest rate cut is expected in June 2024.

Split investment volume

In 2023, office and residential were the asset classes with the highest turnover. The detailed split of the investment volume was as follows: office 28 % (€32.3 billion), residential (from €15 million) 23 % (€26.8 billion), industrial and logistics 17 % (€20.2 billion), retail 16 % (€18.8 billion), and hotel 9 % (€10.5 billion).

Yield analysis

In the fourth quarter of 2023, the price adjustment process continued in most asset classes. The average prime yield for office properties in the key EU-12* investment markets analyzed increased by 30 basis points to 5.05 %, marking the first time since 2014 it has exceeded the 5% mark. In decentralized office locations, the yield for prime properties was about 6.25%.

Retail properties recently recorded slightly lower yield increases. The EU-12 prime yield for commercial buildings was at 4.75 % (+15 basis points). For shopping centers and retail parks, yields of 6.65 % and 6.15 % can be expected.

Logistics properties also showed only minor value adjustments in Q4 2023 due to robust demand. This is reflected in the prime yield for EU-12 Class-A logistics properties of about 5.20 %, with an increase of around 15 basis points in the fourth quarter.

* EU-12 includes Amsterdam, Barcelona, Berlin, Budapest, Frankfurt, Lisbon, Madrid, Milan, Munich, Prague, Stockholm, Vienna; EU-10 = EU-12 excl. Budapest and Prague

** ECB Survey of Monetary Analysts

Demand for residential properties increases

In the residential property sector, there is currently a significantly higher investor demand and a more positive market sentiment than a year ago. The reason for this is the foreseeable massive excess demand for rental apartments in urban areas in the coming years. The EU-10 prime yield for new residential properties was at 4.30 % (+10 basis points QoQ).

Indicators of a recovery in the real estate market

Despite the subdued economic development, the current fundamental data determining user markets showed surprisingly positive signs. "Rising rents, ongoing user demand, low vacancy rates, and the limited new space production, which is expected to continue for at least the next two to three years, create positive conditions for growing dynamics in the investment market in 2024," says Martin Ofner, Head of Market Analysis, optimistically.

Additionally, the yield spread between ten-year German government bonds (2.02 %) and European prime office yields (5.05 %) was already over 300 basis points at the turn of the year. This made real estate investments significantly more attractive compared to competing investment products in recent months. As a result, investors are again showing increased buying interest in currently priced offers.

Challenge of (re-)financing costs

A challenge starting in 2024 will be properties that were acquired during the boom years and currently have significantly higher (re-)financing costs and equity requirements than originally projected. Therefore, it is to be expected that the then largest group of buyers, consisting of major institutional investors, will continue to shape the supply dynamics in the European real estate investment market.