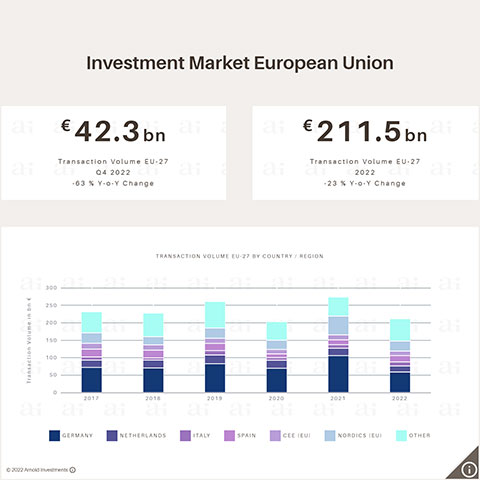

Vienna, 04 December 2024 - According to the latest market analysis published by Arnold Investments, the investment markets in the European Union are showing encouraging signs of bottoming out: The transaction volume amounted to around EUR 27 billion in the third quarter of 2024, continuing the trend of stabilisation seen in the last two previous quarters.

Over the course of the year (Q1-Q3 2024), a total transaction volume of €84 billion was registered. ‘Although this corresponds to a slight decrease of 3 % y-o-y, it can still be interpreted as stabilisation,’ says Markus Arnold, CEO of Arnold Investments. ‘A growing deal pipeline and the transactions already confirmed in the current Q4 2024 make us confident that the previous year's figures in terms of investment volume could be significantly exceeded,’ adds Arnold.

Markets with varying recovery momentum

Major markets such as Italy (+70 %), the CEE region (+34 %), the Netherlands (+29 %) and the Nordics (EU) (+15 %) showed a significant recovery in Q1-Q3 2024 compared to the same period of the previous year. ‘While the German real estate investment market is at least showing signs of bottoming out at around -4 % y-o-y in 2024, the French market, which was still above average in the previous year, performed significantly worse in the first three quarters, falling by around 38 %,’ analyses Martin Ofner, Head of Market Analysis at Arnold Investments. The Austrian investment market is also showing signs of stabilisation with growing momentum, recording an 11 % rise in the first three quarters of 2024.

Performance of the individual asset classes differs widely

In the first three quarters, the volume of industrial and logistics properties traded reached around EUR 20.3bn, putting it ahead of office properties. At +26 % y-o-y, the industrial and logistics sector already recorded a significant upturn in 2024. However, office (-25 % y-o-y) and residential (-13 % y-o-y) segments continued to decline. Particularly in the lower-yielding prime segment of these two sectors, a substantial market recovery can only be expected in line with lower financing costs. Hotel and retail properties also performed well compared to the previous year at +7 % and +12 % respectively.

Cross-border investments are becoming more attractive

At the same time, the investment data from Q3 2024 highlights the renewed interest of investors in transactions outside their domestic market. For the first time since 2022, the majority of the volume was once again generated by international investments. It is expected that this readiness for cross-border deals will continue to grow from Q4 2024, resulting in higher demand on the EU investment market as a whole.

Tailwind for the investment markets due to more favorable debt capital

From a macroeconomic perspective, future economic development and the evolution of interest rates will be the determining factors for the investment market in 2025. The European Commission's autumn forecast predicts economic growth of 1.5 % for the EU in 2025. According to this forecast, in contrast to 2024, all EU countries will have overcome the recession and return to positive GDP growth. ‘It is crucial for investors that the recession ends, especially in the German economy. Confidence and trust in positive economic development form the basis for a sustained strengthening of demand on the user markets,’ says Ofner.

In the light of the significant reductions in key interest rates made by the US and Chinese central banks in autumn, an ambitious interest rate reduction path also appears increasingly likely for the Eurozone. Considering the latest results of the ECB Survey of Monetary Analysts from October 2024, a 3-month Euribor of around 2.95 % is expected by the end of the year. From the second quarter of 2025, this interest rate is projected to be around 2.25 %, which corresponds to a reduction of around 0.65 percentage points compared to the level that had been forecasted a year ago.

Assuming that prime yields will remain roughly stable until the middle of next year, the expected fall in financing costs will result in a spread of around 290 basis points over the 3-month Euribor. As a result, it will once again be possible to realise more attractive returns on equity when investing in prime properties.

Growing investment dynamics towards the end of the year and 2025

A growing deal pipeline and the transactions already confirmed in the current Q4 2024 give confidence that the previous year's figures in terms of investment volume could be significantly exceeded.

The increasingly attractive interest rate environment and the firming bottoming out of the most liquid EU market, Germany, are the breeding ground for high expectations of a dynamic year-end rally. Other factors such as the considerable growth potential in the investment volume in the office and residential sectors due to the lowest capital values since 2017 and the increasing activity in international property investments support the positive forecasts for 2025 overall.