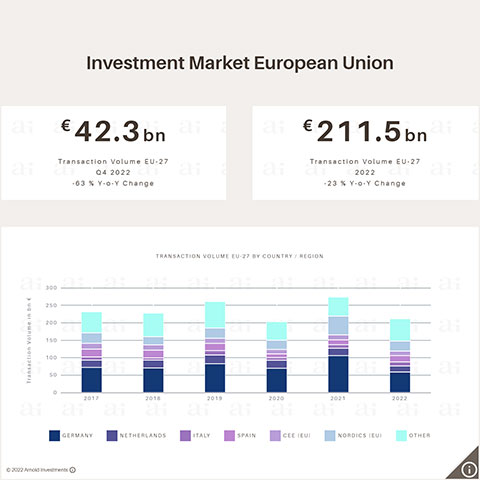

- Multiple countries and regions with double-digit growth rates in investment volume

- Listed real estate companies heading back to the market on the buyer’s side

- EU average prime yields fully stabilized

Vienna, August 22, 2024 - According to the latest market analysis by Arnold Investments, the EU investment market recorded a positive trend in Q2 2024 for the first time since 2022 with a transaction volume of around EUR 28.9 billion (+1% Y-o-Y). Investment activity even increased by around 17% compared to the first quarter of 2024.

However, the recovery is progressing very differently in the individual markets. The heavyweights Germany (-6% Y-o-Y) and France (-11% Y-o-Y) are still in a slight downturn, while all other countries and regions have already recorded significant growth in investment volumes. The strongest growth was recorded in the CEE (EU) region at 64%, followed by the Netherlands (+32%), Italy (+29%), Spain (+14%) and Nordics (EU) (+12%). "With the exception of Spain, these countries and regions are fortunately also seeing a significant recovery in transaction momentum in the first half of the year as a whole," explains Markus Arnold, CEO and founder of Arnold Investments.

Office, residential and logistics are the leading asset classes in Q2 2024

Accounting for a transaction volume of around EUR 13.2 billion and 26% of the total volume, offices remain the strongest asset class in the second quarter. Compared to the same period last year, the investment volume of office properties rose by around 5 %. An even more dynamic recovery can be seen in the area of large-volume residential investments with an increase of around 11% Y-o-Y. " However, in contrast to the stable development in the logistics and hotel sectors, retail property has recorded a decline of around 13% in investment volumes," reports Martin Ofner, Head of Market Analysis at Arnold Investments.

Listed real estate companies heading back to the market on the buyer’s side

The most active buyer groups on the EU investment market in the first half of 2024 continue to be institutional and private investors. While the share of the total volume held by institutional investors fell from 49% to 42% year-on-year, private investors increased their market share from 33% to 38%. In the first half of 2024, occupiers who acquired their rented properties from their previous landlords also recorded a share of 12%, which is well above the long-term average.

Following a virtual freeze on purchases by publicly listed and traded property companies last year (around 2% of the investment volume or roughly EUR 1.2 billion in H1 2023), this group of buyers is becoming more active on the market again in 2024. The transaction volume tripled year-on-year to around EUR 3.6 billion or 8% of the total volume. The retail (+850% Y-o-Y), logistics (+220% Y-o-Y) and residential (+228% Y-o-Y) sectors in particular were the focus of purchasing activities by listed property companies. In contrast, the volume of office property purchases by this group of buyers halved again over the course of the year.

EU average prime yields fully stabilized towards halfway through the year

Having now experienced two years of significant yield increases in each quarter, the development of average prime yields in the major investment markets of the European Union remained stable for the first time in Q2 2024. "Given that only slight increases in yields were registered in the first quarter, we expect yield levels to remain stabilised on a sustained basis," concludes Martin Ofner.

The average prime yield for office properties in the most important EU-12 investment markets analysed remained unchanged at around 5.15% in Q2 2024. Retail properties even recorded a reduction in the EU-12 prime yield of around 5 basis points due to the emerging yield compression in Prague and stand at around 4.80% for high street retail properties, 6.65% for shopping centres and 6.20% for retail parks.

EU-10 includes Amsterdam, Barcelona, Berlin, Frankfurt, Lisbon, Madrid, Milan, Munich, Stockholm, Vienna

Financing conditions improving at a slower pace than expected

At the beginning of August, the 3-month Euribor approached the psychologically important 3.50% mark again for the first time. Forecasts for the further development of interest rates were revised upwards to a small extent on the basis of the delayed interest rate reduction path of the international central banks. According to the latest version of the ECB Survey of Monetary Analysts from July 2024, a 3-month Euribor of around 3.20% is expected by the end of the year. A significantly more attractive interest rate of roughly 2.50% is even considered likely for mid-2025.

Positive outlook towards the end of 2024

Long-term valuation cycles in many EU markets have resulted in significant discrepancies between book values and current market values in recent quarters, making it more difficult for buyers and sellers to find a suitable price at which to close transactions. With the ECB now publicly calling for a swifter adjustment of valuations by various major banks, positive impetus for the transaction market can be expected in the second half of the year.

Despite a slight delay in the reduction of interest rates, financing conditions are expected to improve further by the end of the year and then significantly over the course of next year. Now that both investment activity and yield levels have stabilised in the second quarter, Arnold Investments expects the second half of the year to be characterised by more market activity.