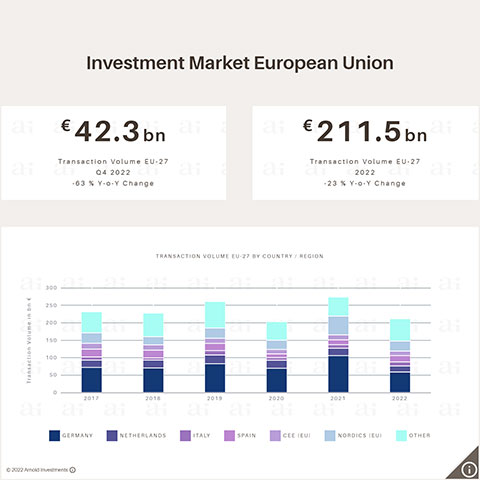

Vienna, May 23, 2024 - According to the latest Arnold Investments Market Analysis, the investment market in the European Union starts the year 2024 with a further decline in transaction volume. In the first quarter, the investment volume amounted to approximately €22.8 billion, representing a reduction in investment activity of around 26% compared to the same quarter of the previous year. However, for the first time since the increase in interest rates during 2022, several major real estate investment markets in the European Union recorded year-on-year growth. The Italian investment market saw an 84% Y-o-Y increase due to several large transactions in the office, logistics, and hotel sectors. Other significant markets like the Netherlands (+42% Y-o-Y) and Sweden (+26% Y-o-Y) also showed positive momentum. In contrast, a continuing downward trend was observed in Germany, Spain, and the CEE region.

Declining inflation and the current tentative recovery in the European Union’s economic growth supports the surprisingly robust user demand in most asset classes. "We expect that the increase in transaction activity observed in some markets will solidify across Europe in the coming quarters," says Markus Arnold, CEO and owner of the brokerage firm Arnold Investments, which operates in ten markets.

Martin Ofner, Head of Market Analysis, explains that private investors were able to increase their share of the investment volume compared to 2023, while owner-occupiers and institutional buyers showed less acquisition activity. This indicates that the portfolio adjustments induced by increased liquidity needs of many institutional owners are not yet complete. "Currently, there are particularly attractive opportunities for equity-strong investors to (re)enter the market," reports Markus Arnold. Listed real estate companies were again notably keener to invest in Q1 2024, contributing around 10% of the transaction volume, following a historic low of only around 3% in 2023.

Industrial and Logistics Properties Remain in Highest Demand

In Q1 2024, industrial and logistics properties were the most sought-after asset class with a share of around 25% (€5.6 billion). While industrial and logistics properties saw a 13% Y-o-Y increase, the transaction volume of office properties (€5.0 billion), the second-strongest asset class, was less than half of the previous year's value. Significant declines compared to last year were also recorded in the residential sector with -28% (€4.0 billion), hotels with -17% (€2.5 billion), and retail with -14% (€4.1 billion).

Only Minor Expansion of EU Average Yields

Especially in the office real estate sector, the expansion of prime yields has slowed significantly. The average prime yield for office properties in the major analyzed EU-12* investment markets rose by 10 basis points to around 5.15%. In decentralized office locations, the yield for class A properties stood at around 6.35% in Q1 2024. EU average yields in the retail segment also rose by 10 basis points. The prime initial yields for investments in the most desirable high street locations on the continent amounted to around 4.85% in Q1 2024. Average prime yields in the logistics (EU-12 Prime Yield: 5.25%), residential (EU-10 Prime Yield: 4.35%), and hotel (EU-12 Prime Yield: 5.70%) sectors remained stable in most markets, showing only marginal increases of up to 5 basis points. As a result of the adjustments over the past two years, yield levels in the individual markets have shifted to very different extents. For example, the lowest prime office yields in Q1 2024 were observed in Stockholm (4.40%) and Milan (4.50%), while the prime yields of the German office markets (Top-7 5.05%) were just below the average.

* EU-12 includes Amsterdam, Barcelona, Berlin, Budapest, Frankfurt, Lisbon, Madrid, Milan, Munich, Prague, Stockholm, Vienna; EU-10 = EU-12 excluding Budapest and Prague

Positive Outlook for the Real Estate Investment Market in 2024

Although the US Federal Reserve is expected to delay interest rate cuts until autumn, it is generally assumed that the European Central Bank will make a first, psychologically important interest rate cut in June, which will be significant not only for the real estate investment market. Economists surveyed in the "ECB Survey of Monetary Analysts" expect that the 3-month Euribor will decrease from around 3.90% at the beginning of the year to 3.02% in December 2024, and then stabilize at around 2.30% in the long term.

This should significantly ease the tight financing situation for both owners and prospective buyers over the course of the year. In addition, investments in real estate have already become significantly more attractive compared to alternative forms of investment. The yield spread between Triple-A government bonds in the Eurozone and EU-12 prime office yields was around 2.80 percentage points at the end of Q1 2024, while it reached already about 4.00 percentage points for the EU-12 office property yields in decentralized locations.

Given the combination of attractive supply, further rising rents, significantly reduced price levels, and lower financing costs in the long term, we expect many investors to take advantage of the historic opportunities available on the market in 2024.