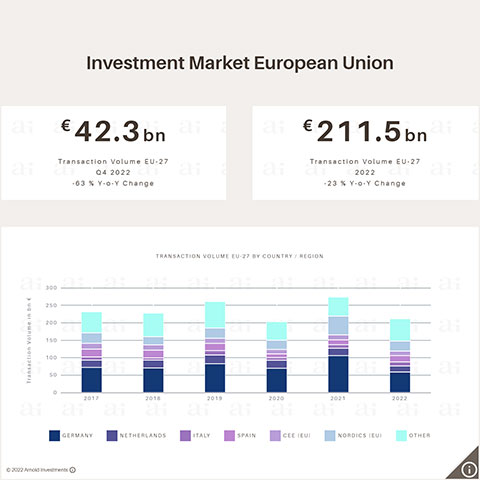

Vienna, 25 May 2023 - The investment volume in the first quarter of 2023 fully reflects the clear investor reluctance at the end of last year. According to a recent Arnold Investments market analysis, a real estate transaction volume of around € 27 billion was recorded in the European Union. Compared to the same quarter in 2022, this is a decline of 60 %. With a few exceptions, an individual analysis of the most important investment markets in the EU reveals a uniform trend: In Germany, the Netherlands and the CEE countries, the transaction volumes each fell by more than 70 % in Q1 2023 compared to the same period of the previous year. “However, we have noticed that more and more investors are becoming active again, especially the equity-strong ones”, Markus Arnold, sole owner and CEO of Arnold Investments, explains, adding: “Hardly ever have there been so many high-quality properties on the market - which, by the way, are all traded off-market - and it is the first movers who will profit from this in particular.”

Bottom out

Based on the sales processes that started in the second quarter of 2023, there are increasing signs that the purchase price expectations of buyers and sellers have now come much closer to one another. “We are currently witnessing that German investors are progressively taking action again”, Jochen Maurer, Country Manager for Germany at Arnold Investments, explains, adding “that the first major deal has already been concluded.”

Despite further increases in key interest rates, recently in smaller steps, a stabilization could be observed both in the long-term financing costs for real estate investments and in the returns on government bonds. “Due to these factors, we assume that the crisis has already bottomed out”, Maurer continues.

Further positive signals are a result of the lively user demand in many areas, which indicates potential for rent increases. The limited offer of new buildings and the declining coverage of housing needs due to the weakening condominium market are leading to growing supply and demand imbalances. “These factors are likely to cause further deterioration in the already strained housing markets in the European metropolitan regions.

Asset classes in detail

The decline in investment activity in the first quarter of 2023 affects all asset classes to a similar extent between minus 56 % in retail and minus 69 % in industrial and logistics properties. An exception is the investment market for hotel properties, which recorded a growth of 9.5 % in Q1 2023 compared to Q1 2022. This development can be attributed to the consistently positive fundamentals in European tourism and the early termination of the previous investment cycle for hotel properties by the pandemic.

Increase in yields across the EU

Throughout the EU, net initial returns for real estate investments reacted to further increases in key interest rates and the declining investor demands with further adjustments. The average prime yield for office properties in 12 markets (Vienna, Prague, Budapest, Milan, Munich, Berlin, Frankfurt, Barcelona, Madrid, Lisbon, Stockholm, and Amsterdam) rose by 22 basic points in Q1 and at 4.27 %, it is already 100 basis points higher than a year ago. At 5.37 % at the end of the first quarter, prime yields for Class A office properties in decentralized office locations recorded a slightly higher increase of 105 basis points year-on-year. An average prime yield of 4.8 % was recorded for a top logistics property in the EU in Q1 2023. The most extensive corrections in prime yields in Q1 2023 were marked in the hotel (EU-12 5.4 %) and residential (EU-10 3.8 %) asset classes with +29 and +26 basis points respectively.

A glance at the Austrian investment market

In Austria, following the Europe-wide trend, investment activity fell significantly in Q1 2023, both quarter-on-quarter and compared to 2022. The investors’ wait-and-see attitude is reflected in the low investment volume of around € 445 million in the first quarter. According to the Arnold Investments market analysis, around half of the transaction volume was accounted for by the office asset class, followed by residential at 22 %, industrial and logistics properties (15 %) and hotels (13 %).

With a share of around 66 %, national investors are currently the most active − a trend that can also be observed in other Western European markets.

Q1 2023: Increase in yields

Further interest rate hikes by the ECB in spring 2023 and the rent increases in both market and index-linked rents led to a further increase in initial yields in Q1 2023. The prime yield for Viennese office buildings rose by 30 basis points to a current 4.0 % and to around 4.85 % in decentralized office locations. The net initial yields in new residential construction in the dynamic investment locations in Vienna (outer districts) and Graz were 4.0 % and 4.5 % at the end of Q1 2023. A significant adjustment of +40 basis points to 5.1 % in Q1 2023 was recorded in the prime yields for Viennese hotel properties with lease agreements.

A revival in demand

“The waiting time seems to be over and the demand is marking a strong increase again, which is underpinned by the latest deal in Germany, just about to be followed by further ones in Austria and other European branches”, Markus Arnold reports.